Investment Strategy

Focus on consumer, SME, and auto leases as underlying collateral, WeShare technology solutions provide investors clear competitive advantage towards achieving superior risk-adjusted returns.

Risk Management with Precision

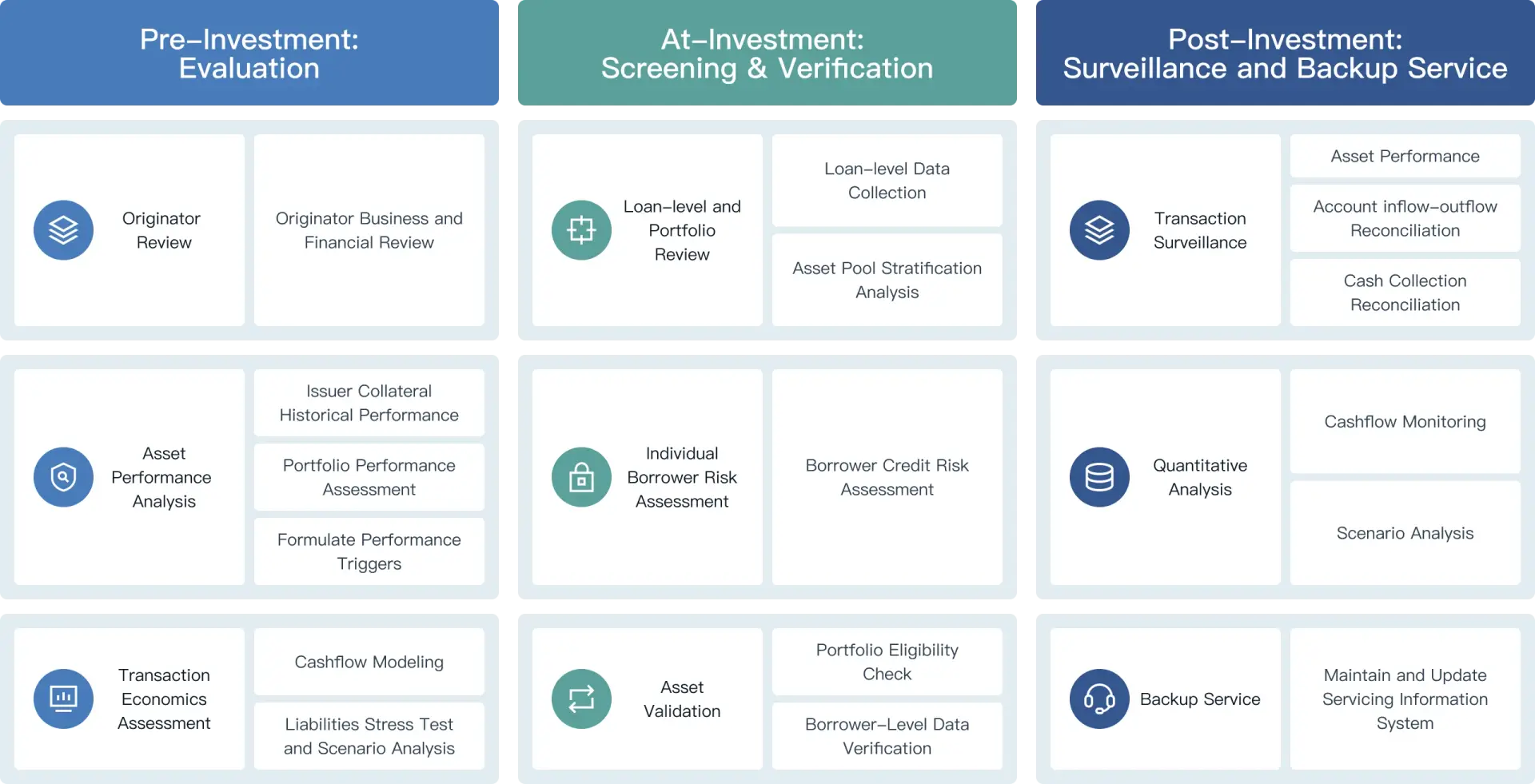

Open the Asset Portfolio Blackbox: By connecting information systems between WeShare and the asset originator, our services provide investors with a full suite of solutions including bottom-up risk assessment conducted at the individual borrower level, information verification, and post-transaction closing real-time performance monitoring. WeShare augments borrower level information with additional third-party data and proprietary risk modeling to provide investors with critical information throughout the investment life cycle: before, during, and after an investment is made.

Mitigating Originator/Servicer Credit Risk: WeShare’s technology solutions and backup servicing offer embed and enhance structural protections in the investment, mitigating insolvency and other operational risks, as well as potential adverse asset selection.

Proactive Asset Management

WeShare has long invested in consumer finance and asset-backed securities businesses, building a close relationship with the issuer community. WeShare’s connectivity provides investors an edge in sourcing assets with strong risk/return potentials from the start of a investment’s planning stage.

Once WeShare and an issuer connect their information technology systems, barriers to entry and future transaction friction costs are significantly lowered which lead to repeated transactions and the ability to meet investors’ investment parameters with targeted asset portfolios.

Alpha (Finding and Delivering Excess Return, Alpha)

WeShare’s technology provides investors with tools to better understand and assess asset quality and performance. Investors are able to pivot their investment analysis away from the originator’s corporate credit profile and focus on the originator’s asset portfolio’s quality and performance on a standalone basis. This pivot vastly expands investors’ investable universe, of particular significance are asset portfolios from less established originators. Focus on assets as opposed to asset originators leads to new opportunities for enhanced risk-adjusted returns, or investment alpha.

WeShare’s risk management services have enabled less established issuers – those typically with smaller balance sheets and shorter operating histories – to also access capital markets with international “AAA” rating. These transactions offer investors compelling risk-adjusted returns as such issuers offer higher yield compared with larger established originators.

Technology-driven Transaction Structuring and Return Optimization

WeShare’s technology platform provides quantitative risk identification and measurement metrics which improves the precision when structuring and optimizing an investment’s risk-adjusted return.

With real-time asset performance monitoring, WeShare can provide investors with exception reporting and other early warning notifications when asset performance begins to deteriorate. As a form of additional investment structural protections, investments that combine this early warning mechanism with pre-set performance triggers have additional remedy options when the pre-set performance triggers are breached – another way for investors to gain superior risk adjusted returns.

Risk Management

WeShare’s risk management is predicated on two sources of credit risk found in most transactions:

— Individual borrower level risk identification and modeling;

— Originator risks which include adverse asset selection, operational risk, and insolvency risk.